Moroccan Military Forum alias FAR-MAROC

Royal Moroccan Armed Forces Royal Moroccan Navy Royal Moroccan Air Forces Forces Armées Royales Forces Royales Air Marine Royale Marocaine

|

|

| | Maroc exploitation du Gaz/pétrole lourd |  |

|

+70dragon-style arsenik Inanç FAR SOLDIER leadlord gigg00 RadOne winner78 lida victor g camps YASSINE farewell AVEROUES sas linust osmali bendari MAATAWI ScorpionDuDesert General Dlimi Northrop IDRISSPARIS Ichkirne yassine1985 mox docleo klan atlasonline yassine149 oussama butters al_bundy Amgala Winner sorius dan iznassen ready H3llF!R3 Proton rafi Cherokee Mr.Jad juba2 FAMAS Yakuza Fremo Nano PGM Adam Viper1912 Leo Africanus Fahed64 Seguleh I atlas marques BOUBOU RED BISHOP DANGO lemay Viper TooNs jonas omar zazoe Harm Samyadams moro metkow Extreme28 Sikorsky 74 participants | |

| Auteur | Message |

|---|

Invité

Invité

|  Sujet: Maroc exploitation du Gaz/pétrole lourd Sujet: Maroc exploitation du Gaz/pétrole lourd  Mer 13 Fév - 21:58 Mer 13 Fév - 21:58 | |

| Rappel du premier message :http://www.osead.com/docs/challenge_hebdo_nov_2007.pdf  |

|   | |

| Auteur | Message |

|---|

Invité

Invité

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Mer 7 Nov - 13:39 Mer 7 Nov - 13:39 | |

| amina  http://www.telexpresse.com/news9359.html |

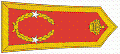

|   | | marques

General de Brigade

messages : 3971

Inscrit le : 05/11/2007

Nationalité :

Médailles de mérite :

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Mar 20 Nov - 14:54 Mar 20 Nov - 14:54 | |

| très bonne nouvelle venant de Pura Vida : très bons indices révélés par l'analyse chimique des échantillons de carottages sur le permis de Mazagan. Le forage d'exploration s'approche. - Citation :

- CONFIRMATION OF OIL IN DROP CORES

Pura Vida Energy NL (“Pura Vida” or the “Company”) (ASX:PVD) is pleased to announce that further geochemical analysis on the cores acquired by Pura Vida’s drop core program on its Mazagan permit offshore Morocco, has confirmed several cores contain light oil saturation.

The further analysis has been undertaken by specialist group Geomark & Geochemical Solutions International in Houston. The cores containing oil are located proximate to the Amchad prospect as well as Pura Vida’s largest prospect, Toubkal, which has an estimated mean resource potential of 1,507 mmbo.

The analysis confirms the presence of chemical compounds (biomarkers) indicating the source rock for the oil is the Lower Jurassic, as has been previously proposed by the Company as the main source of hydrocarbons for the Mazagan permit.

Pura Vida’s Technical Director Dave Ormerod says, “This result confirms that oil is migrating through the Mazagan permit and provides encouraging evidence to support that the large structures seen on 3D can be charged.”

With the completion of technical work on Mazagan, Pura Vida is now focused on the farmout and drilling program.

About Pura Vida Energy: Pura Vida is an Australian-based African oil explorer building a portfolio of high quality http://www.puravidaenergy.com.au/news_pdf/ASX_55_-_Confirmation_of_Oil_in_Drop_Cores_-_20_Nov_12.pdf | |

|   | | sorius

Commandant

messages : 1139

Inscrit le : 18/11/2010

Localisation : france

Nationalité :

Médailles de mérite :

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Mar 20 Nov - 17:30 Mar 20 Nov - 17:30 | |

| merci marques

super nouvelle on attend l accomplissement du processus bientôt avec inchaalah de bons résultats

encore deux ans à espéré | |

|   | | yassine1985

Colonel-Major

messages : 2948

Inscrit le : 11/11/2010

Localisation : Marrakech

Nationalité :

Médailles de mérite :

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Mer 21 Nov - 11:16 Mer 21 Nov - 11:16 | |

| - Citation :

Genel Energy again expands Morocco footprint

Anglo-Turkish oil firm Genel Energy (LON:GENL) has again expanded its footprint in Morocco.

It has signed a petroleum agreement with the Office National des Hydrocarbures et de Mines (ONHYM) for the Mir Left Offshore Block.

Genel has a 75% stake and will be the operator of the new offshore block, while ONHYM retains a 25% stake.

Initially Genel must acquire a minimum of 400 square kilometres of 3D seismic data and drill one exploration well over a three year exploration period. Beyond that there are two further exploration periods – for three and two years respectively.

"We are delighted to have signed this new block, further deepening our position in the fairway associated with the proven working petroleum system in offshore Morocco,” said John Hurst, Genel’s chief operating officer for Africa.

“We intend to commence the acquisition of 3D seismic in January 2013, with the aim of drilling our first well in 2014."

Mir Left spans 3,259 square kilometres, in water depths of 60 to 320 metres, and lies immediately adjacent to the Sidi Moussa block.

Genel recently acquired a 60% stake in Sidi Moussa - a venture which also includes Serica Energy (LON:SQZ), San Leon (LON:SLE) and Longreach Oil & Gas (CVE:LOI).

Src

_________________

."قال الرسول صلى الله عليه وسلم : "أيما امرأة استعطرت فمرّت بقوم ليجدوا ريحها فهي زانية

| |

|   | | dan

Capitaine

messages : 936

Inscrit le : 02/11/2010

Localisation : FRANCE

Nationalité :

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Jeu 22 Nov - 15:56 Jeu 22 Nov - 15:56 | |

| - Citation :

- Fastnet Oil & Gas

www.fastnetoilandgas.com

Fastnet Oil & Gas plc (FAST) is an independent oil and gas exploration company focused on identifying early stage exploration and appraisal opportunities in Offshore Ireland and Africa. It is quoted on the AIM market of the London Stock Exchange and the Enterprise Securities Market (ESM) of the Irish Stock Exchange. Fastnet's immediate...

Read more

Full Fastnet Oil & Gas profile here

Is FAST a Buy, Sell or Hold?Get your FREE analysis of FAST

inShare

Pdf

Email

Fastnet Oil & Gas raise £15 mln for Morocco drilling

2:14 pm by Jamie Ashcroft It is expected that Fastnet’s first exploration well will be drilled offshore Morocco in the second half of next yearIt is expected that Fastnet’s first exploration well will be drilled offshore Morocco in the second half of next year

Fastnet Oil & Gas (LON:FAST) has raised £15 mln through a share placing to fund a drill programme in Morocco.

It is issuing 68 mln new shares to new and existing investors at 22p each.

The company says the funding will allow the company to accelerate drilling activity in offshore Morocco, as well as fund other work programmes in the Celtic Sea.

The money will also provide additional working capital headroom, Fastnet added.

"[The placing] is a testament to the portfolio of assets, management team and progress since our admission to AIM and ESM that Fastnet has been able to secure the support of significant new investors and continuing support from existing shareholders,” said chairman Cathal Friel.

"With the new money raised, Fastnet will be able to execute its strategy of maturing its enlarged licence area in Morocco and the Celtic Sea to a point at which it can secure shareholder value through the support of future potential farm-in partners."

The placing was arranged by Mirabaud Securities and Shore Capital.

It is expected that Fastnet’s first exploration well will be drilled offshore Morocco in the second half of next year, while drilling is likely to start offshore Ireland in 2014. | |

|   | | Invité

Invité

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Sam 1 Déc - 15:39 Sam 1 Déc - 15:39 | |

| - Citation :

- Maroc : Total aurait négocié un immense bloc pétrolier au Sahara

(Agence Ecofin) - La compagnie pétrolière Total aurait signé avec le Maroc un accord de prospection pétrolière au Sahara occidental sur un gigantesque bloc, Anzarane Offshore, de plus de 100 000 km2.

L’information, révélée par Western Sahara Resource Watch (WSRW), semble confirmée par une étude de la banque Mirabaud (Mirabaud Securities à Londres) qui attribue en effet à Total une participation de 75% dans le bloc Anzarane Offshore.

Une autre étude de VSA Capital fait état d’une vaste licence offshore récemment signée avec le Maroc.

« En faisant cela, Total compromet directement les efforts de paix de l'ONU et sabote le droit international. Nous lançons un appel à la société pour reconsidérer immédiatement son implication », a déclaré Erik Hagen, président de Western Sahara Resource Watch.

Selon WSRW, TotalFinaElf avait déjà tenté de se faire attribuer cette licence en 2001 mais s’était alors heurté au Conseil de Sécurité, interpellé par le Secrétaire général adjoint aux affaires juridiques, Hans Corell.

http://www.agenceecofin.com/investissement/0112-7845-maroc-total-aurait-negocie-un-immense-bloc-petrolier-au-sahara-occidental

|

|   | | marques

General de Brigade

messages : 3971

Inscrit le : 05/11/2007

Nationalité :

Médailles de mérite :

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Lun 3 Déc - 10:25 Lun 3 Déc - 10:25 | |

| Annonce ce matin de la Farm-Out sur la zone de Tarfaya pour 41 Millions dollars plus le coût du forage à mi 2014. très intéressant Galp qui est un opérateur global Portugais et qui surtout connait très bien l'off-shore, les marges atlantiques et les bassins pré-salières : Brésil, Angola, Guinée Bissau ..Il est en train d'enchainer des découvertes au Mozambique et au Bresil. Tangiers garde 25% à côté de l'ONHYM qui doit donner son aval à l'accord. l'ONYHM espérait plutôt un forage à mi-2013. - Citation :

Galp Energia enters into a farm-in agreement for offshore Morocco

12/03/2012| 04:51am US/Eastern

Galp Energia announces its has entered into a farm-in agreement with the Australian company, Tangiers Petroleum Limited (Tangiers), for the acquisition of a 50% stake in the Tarfaya Offshore area, comprising eight exploration permits, known as Tarfaya Offshore I to VIII, located on the Atlantic Margin, offshore Morocco.

Upon completion of the agreement, Galp Energia will be the operator of the Tarfaya Offshore area, a role that until now has been fulfilled by Tangiers. The Tarfaya Offshore area is predominantly in water depths of less than 200 metres and covering an area of 11,281 square kilometres.

After finalisation of this agreement, Tangiers will hold a stake of 25%, and the Office National des Hydrocarbures et des Mines, (ONHYM), the Moroccan state company, will maintain a 25% stake in the Tarfaya Offshore area.

Under the terms of this agreement, Galp Energia will pay in exchange for its 50% interest around US$41 million which corresponds to past costs and to the cost of the first exploration well, limited by a cap, to be drilled within the Tarfaya Offshore area.

The Tarfaya Offshore permits are located in an under-explored area and within a proven petroleum system, containing multiple prospects and leads within Jurassic and Cretaceous sediments, as well as emerging potential within the Tertiary and Triassic formations. The already identified prospects in the Tarfaya Offshore Area include Assaka, Trident, Tarfaya Marin-A (TMA) and La Dam.

The exploration programme is expected to comprise the drilling of an exploration well, before mid 2014 in the Trident prospect.

According to Galp Energia's internal estimate of volumes and risk, the Trident prospect, which corresponds to the primary target is an oil prone prospect and has estimated gross recoverable exploration resources of 450 million barrels (mean unrisked estimate) with a POS of 21%. It should be highlighted that further resource upside potential remains in the Assaka, TMA and La Dam prospects.

The transaction is subject to the required regulatory approvals, namely the approval of the Moroccan government.

This farm-in agreement reflects Galp Energia's execution of its long term strategy in order to expand and diversify the Company's exploration portfolio, to secure the sustainability of its production growth. Galp Energia continues to leverage on its early mover profile, entering in the early phase of the exploration stage to capture the most value creation potential. It is important to highlight that within this agreement Galp Energia will further develop its technical skills as an operator into shallow water offshore projects.

http://www.4-traders.com/GALP-ENERGIA-NOM-35373/news/GALP-ENERGIA-NOM-Galp-Energia-enters-into-a-farm-in-agreement-for-offshore-Morocco-15570382/ | |

|   | | Invité

Invité

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Lun 3 Déc - 17:26 Lun 3 Déc - 17:26 | |

| - Citation :

- Galp va exploiter un gisement pétrolier au large du Maroc

Lisbonne - Galp Energia a acquis auprès de l'explorateur pétrolier australien Tangiers 50% du projet d'exploitation du gisement Tarfaya Offshore au large du Maroc pour un montant de 31,4 millions d'euros, a annoncé lundi le groupe pétrolier portugais.

Selon les termes de cet accord comprenant huit licences d'exploitation, Galp Energia remplacera Tangiers en tant qu'opérateur dans cette zone qui se situe pour la plupart à des profondeurs inférieures à 200 mètres et qui couvre 11.281 km2, a précisé le groupe dans un communiqué.

La participation de Tangiers passera à 25% et celle de l'Office national des hydrocarbures et des mines, entreprise d'Etat du Maroc, se maintiendra à 25%, a-t-il ajouté en indiquant que le forage du premier puits d'exploitation doit intervenir avant la fin du premier semestre 2014.

Galp Energia, déjà présent au Brésil et au Venezuela puis dans les anciennes colonies portugaises comme l'Angola ou le Mozambique, compte ainsi étendre et diversifier son portefeuille de projets d'exploitation et développer ses compétences techniques en tant qu'opérateur dans des projets offshore en eaux peu profondes.

GALP ENERGIA (©AFP / 03 décembre 2012 16h16) http://www.romandie.com/news/n/_Galp_va_exploiter_un_gisement_petrolier_au_large_du_Maroc59031220121618.asp Edit MTW : met les citations à tes postes |

|   | | yassine1985

Colonel-Major

messages : 2948

Inscrit le : 11/11/2010

Localisation : Marrakech

Nationalité :

Médailles de mérite :

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Mer 19 Déc - 11:38 Mer 19 Déc - 11:38 | |

| - Citation :

prepared to drill maiden well off the coast of Morocco next year

Irish exploration firm, Fastnet Oil & Gas is set to drill its maiden well — off the coast of Morocco — at the tail-end of next year.

Last month, the firm raised over €18m in a heavily oversubscribed share placing, in order to fund the Moroccan drilling programme.

Some of the proceeds were also earmarked for the company’s 3D seismic survey in the Celtic Sea, also scheduled for 2013.

Cathal Friel, Fastnet’s executive chairman, said yesterday that the last six months had been "a transformational period" for the company and its shareholders; adding the foundations of an oil and gas exploration firm had successfully been built.

"The company is now focused on delivering the next stage in the value- creating cycle through the drill bit," he said.

The company should drill its first exploration well at its Foum Assaka asset, offshore Morocco in the fourth quarter of next year.

Yesterday saw the publication of Fastnet’s half-year results, for the six months to the end of September; showing a net loss of £1.5m (€1.84m); a figure largely seen as irrelevant at this early stage of the company’s life, by analysts.

"Of greater interest is the net cash position of £8.4m. We assumed net cash of £8.3m as of September and a full year outcome of £7.7m.

"Last month, however, Fastnet raised £15m by way of a placing and as a result is fully funded to meet all current licence commitments and obligations in both Morocco and Ireland," noted Goodbody Stockbrokers.

Meanwhile, Dublin- based Petroneft Resources has updated on drilling activity at its Arbuzovskoye field in the Tomsk region of Russia. It said the fourth production well of a scheduled ten well programme has yielded an initial flow rate of 150 barrels of oil per day.

Current production at the company’s Licence 61 is running at 2,800 barrels of oil per day; compared to 2,500 last month

http://www.irishexaminer.com/business/fastnet-prepared-to-drill-maiden-well-off-the-coast-of-morocco-next-year-217405.html - Citation :

Gulfsands Petroleum acquires Cabre Maroc in Morocco

LONDON (SHARECAST) - AIM-listed oil and gas production company Gulfsands Petroleum has reached an agreement with the Caithness Petroleum Limited Group to acquire Cabre Maroc Limited, a wholly-owned subsidiary and operator of a portfolio of highly prospective oil and gas exploration licences and gas exploitation concessions in northern Morocco.

The total consideration for the transactions will result in cash payments totalling approximately $19m by way of purchase consideration and the refundable provision of up to $11.5m of financial guarantees made to ONHYM, the regulator of Morocco's oil and gas sector, and up to $11m in funding a portion of Caithness's pro-rata share of the cost of exploration activities on two of the permit areas in which Caithness has retained minority participating interests.

Completion of the acquisition of Cabre Maroc is anticipated for mid-January 2013 following approval of the transaction by Caithness's shareholders. The transaction is not subject to regulatory approval.

Following completion of the acquisition and various post-completion matters, Gulfsands and Caithness Petroleum will become co-venturers with ONHYM in respect of the Fes and Taounate Permits through their respective wholly owned subsidiaries, with Gulfsands the operator of both exploration joint ventures.

Commenting on this announcement, Ric Malcolm, Gulfsands Chief Executive Officer, stated: "We believe this acquisition represents a tremendous opportunity to develop a substantial business in Morocco, with potential near term cash flow and exciting exploration upside and in a country well recognized for its stability and attractive fiscal terms. These fiscal terms ensure that the discovery of even a relatively modest volume of recoverable oil or gas on either of the Fes and Taounate Permits would deliver very significant value to our shareholders.”

http://www.sharecast.com/cgi-bin/sharecast/story.cgi?story_id=20576458

_________________

."قال الرسول صلى الله عليه وسلم : "أيما امرأة استعطرت فمرّت بقوم ليجدوا ريحها فهي زانية

| |

|   | | Invité

Invité

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Ven 21 Déc - 16:19 Ven 21 Déc - 16:19 | |

| - Citation :

(Agence Ecofin) - La compagnie pétrolière anglaise Gulfsands Petroleum va acheter à Caithness Petroleum sa filiale marocaine Cabre Maroc pour 19 millions de dollars.

Selon Gulfsands, Cabre Maroc dispose, dans le Nord Maroc, sur 13350 km2, de licences d’exploration de pétrole et de gaz « très prometteuses » ainsi que de concessions d’exploitation de gaz.

« Cette acquisition de Cabre Maroc offre à Gulfsands une position majeure sur un espace à fort potentiel pétrolier, doté d’un plan de développement de production commerciale de gaz dès le 3eme trimestre 2013 » indique le communiqué de la compagnie.

L’opération d’achat de Cabre Maroc devrait être finalisée pour la mi-janvier 2013, suite à l'approbation de la transaction par les actionnaires de Caithness.

Plus d’informations sur la transaction et les permis concernés

http://www.gulfsands.com/s/morocco.asp

Cabre Maroc

On December 19, 2012 Gulfsands Petroleum reached an agreement with the Caithness Petroleum to acquire Cabre Maroc, a wholly owned subsidiary and operator of an extensive portfolio of highly prospective oil and gas exploration licences and gas exploitation concessions covering an area of more than 13,000 square kilometres in northern Morocco.

The purchase of Cabre Maroc delivers to Gulfsands a large, contiguous and highly prospective acreage position in an area with proven petroleum systems, revenues from near term production, and multiple drilling targets. The Company believes that there is meaningful near term value potential contained within the proven conventional and shallow depth gas play in the Rharb Centre permit, together with significant exploration upside related to the fold and thrust belt structures identified in the adjacent Rharb Sud, Fes and Taounate permits.

Completion of the acquisition of Cabre Maroc is anticipated for mid-January 2013 following approval of the transaction by Caithness's shareholders. The transaction is however not subject to regulatory approval.

Following Completion of the acquisition and various post Completion matters, Gulfsands and Caithness Petroleum through their respective wholly owned subsidiaries will become co-venturers with ONHYM in respect of the Fes and Taounate Permits, with Gulfsands the operator of both exploration joint ventures.

Gulfsands will therefore be the operator of and hold participating interests in the following oil and gas exploration permits and gas exploitation concessions onshore northern Morocco:

Exploration Permits:

Name of exploration permit Participating interest Area at Completion Remaining term

Rharb Centre Gulfsands: 75%

ONHYM: 25%* 1,358.7 km2 1st extension period expiring 9th July, 2013 and 2nd extension period expiring 9th July 2014

Rharb Sud Gulfsands: 75%

ONHYM: 25%* 1,357.5 km2

Name of exploration permit Participating interest Area at Completion Remaining term

Fès Gulfsands: 50%

Caithness: 25%

ONHYM: 25%* 1,598.85 km2 1st extension period expiring 25th March, 2012 and 2nd extension period expiring 25th September 2015

Taounate Petroleum Agreement

Cabre Maroc has reached agreement with ONHYM for the award of a new Petroleum Agreement including Exploration Permits covering approximately 9,037 km2 of the Taounate region to the north and east of the Fes Permit. The Taounate Permits will be granted for an 8 year term, with the following participating interests:

Gulfsands: 45%

Caithness: 30%

ONHYM: 25%*

The Taounate Petroleum Agreement follows on from the Taounate Reconnaissance Licence previously held by Cabre Maroc. The terms of the Petroleum Agreement have been agreed with ONHYM and it is therefore anticipated to be signed and submitted for Ministerial approval early in 2013.

* ONHYM's share of exploration and appraisal expenditures is carried by the other parties to these exploration permits on a pro rata basis to their participating interests. ONHYM becomes responsible for its pro rata share of development and operating costs from the date of commencement of the Exploitation Concession.

Gas Exploitation Concessions:

The government of Morocco has granted Cabre Maroc long term Exploitation Concessions to permit the development of gas discoveries previously made in the area of the Rharb Centre exploration permit. These Exploitation Concessions are excised from the Exploration Permits.

Name of concession Fields Period of validity Participating interests

Zhana 1 Zhana 1 2000 to 2025 Gulfsands: 65%

ONHYM: 35%

Zhana 2 Zhana 2

Zhana 3 2003 to 2018 Gulfsands: 75%

ONHYM: 25%

Sidi Amer 1 Sidi Amer 1 2004 to 2019 Gulfsands: 75%

ONHYM: 25%

Fes and Taounate Permits:

These permits lie within a fold and thrust belt domain. To date, both permits have seen only very limited exploration with only one well having been drilled in each permit, one of which was drilled off-structure in the Fes Permit and the other tested gas. Immediately west of the Fes Permit are three small and apparently depleted oil fields that had produced light oil at commercial rates. The primary reservoir for these fields is the Haricha Formation, a deltaic sandstone of late Jurassic age which exhibits excellent reservoir characteristics. Oil seeps have also been identified on or near both permit areas.

Gulfsands is preparing plans for an intensive exploration programme on the Fes Exploration Permit commencing early in 2013 with the acquisition of approximately 1,000 line km of 2D seismic data in order to identify potential drilling locations on some of the dozen or so leads previously identified by utilizing existing Full Tensor Gravity data as well as legacy seismic data. Following evaluation of the 2D seismic data, the Company anticipates the drilling of at least three exploration wells within this permit area, commencing early 2014.

Exploration success on the Fes Permit is expected to have a significant and positive impact on the Taounate Permits. A programme of acquisition of Full Tensor Gravity data (approximately 10,000 line km) and 2D seismic data (approximately 350 line km) on the Taounate Permits is therefore planned for 2013.

Rharb Permits

The Rharb Centre Permit lies within a foreland basin (Rharb Basin). Contained within are discrete turbidite channel and fan sands of Upper Miocene age that provide excellent reservoirs for biogenically sourced natural gas accumulations (99% methane). Five exploration wells have so far been drilled on the permit and all of them were gas discoveries. Those wells have since been completed as producers and successfully run on Extended Production Tests.

A Competent Person's Report on the Rharb Permits prepared by Senergy Oil & Gas Limited for Cabre Maroc in July 2012 reported 2P reserves of 0.6 billion standard cubic feet ("bscf"), 2C contingent resources of 1.4 bscf and P50 prospective resources of 24.4 bscf.

Within the immediate vicinity of the Rharb Permits, there is existing demand for the sale of natural gas to local industry, made possible by access to an existing network of gas pipelines which transect the license area. It is therefore anticipated that revenues from the sale of gas discovered, developed and produced will begin to be received by the third quarter of 2013. Current development plans suggest that production for 2014 could average approximately 7 million standard cubic feet per day ("mmscf/d") and be expected to continue at that level for at least five years.

Further, these natural gas accumulations are typically identified through analysis of seismic amplitude data and particularly high geologic success rates have been achieved when drilling locations have been identified utilizing 3D seismic data. A 3D seismic survey of approximately 300 km2 has been recently acquired by Caithness over part of the Rharb Centre Permit and processing of these data is anticipated to be completed by March 2013. An extensive drilling programme, of at least five and possibly up to nine exploration wells, is therefore planned to be drilled during 2013 on prospects delineated by the new 3D seismic data.

Individual gas prospects are relatively modest in terms of reserves but are generally located at quite shallow drilling depths (500 - 1500 metres) such that drilling and completion costs, particularly in a multi-well programme, are also relatively modest at approximately US$1.5 million (gross) per well. As the natural gas produced is almost pure (99%) methane, minimal surface processing is required and cycle time from discovery to production can generally be measured in weeks rather than years. |

|   | | Nano

Colonel

messages : 1650

Inscrit le : 17/05/2009

Localisation : Brest - Rabat

Nationalité :

Médailles de mérite :

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Mar 1 Jan - 20:42 Mar 1 Jan - 20:42 | |

| encore du nouveau Marque  - Citation :

- 20/12/2012

Maghreb Confidentiel N°1045

MAROC

Après Total, Chevron en quête de brut

2013, année de l’or noir ! Jusqu’à présent terrain de jeu pratiquement exclusif des juniors, le secteur pétrolier marocain commence à attirer les mastodontes du secteur. (...) [204 mots] [5€] http://www.africaintelligence.fr/MC-...,107937215-ART - Citation :

- 18/12/2012

Africa Energy Intelligence N°689

MAROC

Tangiers s’allège pour rebondir

Grâce à un accord avec la major portugaise Galp, la junior Tangiers Petroleum, dirigée par l’ancienne vice-présidente de Woodside, va pouvoir assouvir ses ambitions africaines. [225 mots] [5€] http://www.africaintelligence.fr/LAE...,107936792-ART - Citation :

04/12/2012

Africa Energy Intelligence N°688

MAROC

ONHYM

Genel Energy, la société de l’ex-PDG de BP Tony Hayward, vient d’acquérir auprès de l’Office national des hydrocarbures et des mines (ONHYM) le permis de Mir Left qu’elle va pouvoir opérer avec une participation de 75% (ONHYM contrôlera le reste). (...) [99 mots] [1,5€] http://www.africaintelligence.fr/LAE...,107934872-BRE | |

|   | | marques

General de Brigade

messages : 3971

Inscrit le : 05/11/2007

Nationalité :

Médailles de mérite :

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Mer 2 Jan - 10:34 Mer 2 Jan - 10:34 | |

| Nano ..: good news !! Chevron : peut-être en farm-out avec Pura Vida sur le permis de Mazagan ou avec Kosmos Energy ou les zones libres au Sud de Casablanca ? sinon je ne vois pas d'autres perspectives disponibles chez l'ONHYM et taillé pour ce type d'operateur qui n'intervient qu'à partir du milliard de baril minimum .. Chevron c'est du très lourd !!! une grosse Major dans le domaine de l'off-shore (GOM, Netherlands, UK, Angola, Bresil , Australie etc....) wait and see...en tous les cas, çà sera un très bon signe pour 2013-2014  | |

|   | | dan

Capitaine

messages : 936

Inscrit le : 02/11/2010

Localisation : FRANCE

Nationalité :

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Mer 2 Jan - 16:04 Mer 2 Jan - 16:04 | |

| - Citation :

- Pétrole : Chevron débarque discrètement au Maroc

Source : Lakome | 21 décembre 2012

L’américain Chevron vient de créer une filiale au Maroc, dédiée à l’exploration d’hydrocarbures.

Le géant pétrolier vient tout juste de créer une filiale marocaine, « Chevron Morocco Exploration Limited Morocco Branch», dédiée à l’exploration gazière et pétrolière ainsi qu’à «la réalisation d’activités de production au Maroc». C’est un cadre marocain du groupe, Ali Azizi, basé au Texas, qui va en assurer la direction.

Quelle est la cible de Chevron dans le royaume ? Cela reste un mystère pour l’instant : le groupe américain n’a pas communiqué sur le sujet et l’Office marocain des hydrocarbures (ONHYM), qui délivre les permis d’exploration, n’a pas souhaité répondre aux questions de Lakome.

33 milliards $ d’investissements prévus en 2013

Le 5 décembre dernier, Chevron a présenté son programme prévisionnel d’investissement pour 2013 : 33 milliards de dollars consacrés à ses activités d’exploration et de production, notamment en Australie, au Nigeria, aux USA, au Kazakhstan, en Angola ou encore au Congo. Mais pas une seule allusion au Maroc…

Bien que sa production déclarée de pétrole et de gaz naturel soit à son plus bas niveau depuis 2008, Chevron, quatrième groupe énergétique mondial, est assis sur un véritable trésor de guerre : 21,3 milliards de dollars de réserves en cash. La plupart des analystes du secteur s’attendent à ce que le groupe utilise ces réserves prochainement pour acquérir une ou plusieurs sociétés de taille inférieure, spécialisées dans l’exploration de nouveaux gisements. Parmi les noms qui circulent : Kosmos Energy Ltd, qui a découvert et exploite le champ Jubilee au Ghana, nouvel eldorado ouest-africain, mais qui détient aussi plusieurs permis sur les côtes mauritaniennes et marocaines (au large d’Essaouira, d’Agadir et de Boujdour).

Dernière édition par dan le Mer 2 Jan - 16:18, édité 1 fois | |

|   | | RED BISHOP

Modérateur

messages : 12303

Inscrit le : 05/04/2008

Localisation : france

Nationalité :

Médailles de mérite :

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Mer 2 Jan - 16:07 Mer 2 Jan - 16:07 | |

| Comme certain l'avait prédit sur ce forum

les petite entreprises de prospection a l'air d'avoir fini leur boulot et vont vendre leur découverte au Grande Entreprise Pétrolière

Chevron, Total, Galp _________________  | |

|   | | dan

Capitaine

messages : 936

Inscrit le : 02/11/2010

Localisation : FRANCE

Nationalité :

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Mer 2 Jan - 16:16 Mer 2 Jan - 16:16 | |

| info sur chevron interessante que je viens de trouver: - Citation :

- Réf. : C-0069245/12

ANNONCES LEGALES

CHEVRON MOROCCO EXPLORATION LIMITED

AU CAPITAL DE 10.000 $

11 Church Street, Hamilton, HM 11, Bermudes

RC Hamilton Bermudes n° 46720

Aux termes du procès verbal des décisions du Conseil du 22 octobre 2012 à Hamilton - Bermudes, enregistré à Casablanca en date du 19 novembre 2012,

La société sus-mentionnée, a décidé la création d’une succursale dénommée « CHEVRON MOROCCO EXPLORATION LIMITED MOROCCO BRANCH » à Casablanca au 219 Bd Zerktouni – 1er étage – Appartement n° 1 - Résidence El Bardai - Maroc. Le Directeur en sera Monsieur Ali Azizi, de nationalité américaine, né le 20 septembre 1958, titulaire du passeport n° 488987756 et demeurant 1400 Smith, Houston, TX 77002 (USA).

Le dépôt du dossier de constitution a été fait au Centre Régional d’Investissement de la Wilaya de Casablanca.

Son activité consiste en l’exploration pétrolière et gazière et la réalisation d’activités de production au Maroc.

La succursale a été immatriculée au Registre du Commerce de Casablanca sous le n° 271439.

Pour avis, le Représentant Légal

publié le : 17.12.2012 | |

|   | | marques

General de Brigade

messages : 3971

Inscrit le : 05/11/2007

Nationalité :

Médailles de mérite :

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Mer 2 Jan - 23:51 Mer 2 Jan - 23:51 | |

| ça vient de tomber !! - Citation :

- Plains Exploration Signs Agreement for Offshore Moroccan Project; January 02, 2013, 05:16:55 PM EDT

Plains Exploration & Production Company ( PXP ) has entered into a definitive agreement to participate in Mazagan permit area offshore of Morocco.

Subject to customary closing conditions including the receipt of Moroccan governmental approvals, PXP will make a cash payment of $15 million to farm-in to Pura Vida Energy's 75% working interest in the 2.7 million acre Mazagan permit area.

PXP will earn a 52% working interest and act as operator in exchange for funding 100% of the costs of certain specified exploration activities that will include a commitment to fund and drill two wells, and if agreed, various additional exploration operations subject to a maximum of $215 million.

PXP shares are unchanged after hours at $47.50, after establishing a new year top of $48.00 during the regular session.

The first exploration well will primarily target the Toubkal prospect and is expected to be drilled in 2014.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of The NASDAQ OMX Group, Inc.

- Citation :

- HOUSTON , 2 janvier 2013 / PRNewswire / - Plains Exploration & Production Company (NYSE: PXP) ("PXP" ou la "Société") annonce aujourd'hui qu'elle a conclu un accord définitif pour participer à la mer jeu. exploration important et très prometteur Maroc .

Sous réserve des conditions de clôture habituelles, y compris l'obtention des approbations gouvernementales marocaines, PXP fera un paiement en espèces de 15 millions de dollars à la ferme pour Pura Vida Energy (ASX: PVD) («PVD») participation de 75% travaillent dans les 2,7 millions d'hectares au large zone de Mazagan permis Maroc .

PXP va acquérir une participation de 52% de travail et d'agir en tant qu'opérateur en échange d'un financement à 100% des coûts de certaines activités d'exploration prévues, qui comprendront un engagement à financer et à forer deux puits, et en cas d'accord, divers travaux d'exploration supplémentaires sous réserve d'un maximum de 215 millions de dollars .

Le premier puits d'exploration visera principalement la perspective du Toubkal et devrait être foré en 2014.

La zone de permis Mazagan se situe au large de la côte de Maroc dans le Essaouira bassin et comprend de nombreuses Mid Miocène inférieur et du Crétacé perspectives identifiées sur la base récemment retraités données sismiques 3D.

Une évaluation indépendante des ressources complétée par DeGolyer and MacNaughton en Septembre 2012 a estimé les ressources récupérables prospectives à plus de 7 milliards de barils, dont 1,5 milliards brut pour Toubkal mi Miocène perspective.

PXP est une compagnie indépendante et de gaz principalement engagés dans les activités d'acquisition, le développement, l'exploration et la production de pétrole et de gaz dans Californie , Texas , Louisiane , golfe du Mexique . PXP a son siège à Houston, Texas . | |

|   | | sorius

Commandant

messages : 1139

Inscrit le : 18/11/2010

Localisation : france

Nationalité :

Médailles de mérite :

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Jeu 3 Jan - 0:08 Jeu 3 Jan - 0:08 | |

| | |

|   | | FAR SOLDIER

General de Division

messages : 7880

Inscrit le : 31/08/2010

Localisation : Nowhere

Nationalité :

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Jeu 3 Jan - 1:12 Jeu 3 Jan - 1:12 | |

| Dailleurs , moi depuis que je suis nee et que j ai commencer a raisonner normalement , je me posait toujours cette question , comment se fait il que le Maroc n a pas de petrole ou de gaz , alors que tt les pays qui nous entourent en ont ! Je trouvais sa completement illogique et j etait persuades que un jour ou l autre ont aller en trouver . Donc quand je vois ces nouvelles , je me dit , je suis pas completement fou Hamdoullah .  Yarrebi on en trouve juste pr notre consommation personnel au moins ! sa soulagera la tresorerie du pays d une facon considerable ! | |

|   | | atlasonline

Colonel-Major

messages : 2010

Inscrit le : 23/05/2010

Localisation : Maroc

Nationalité :

Médailles de mérite :

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Jeu 3 Jan - 12:36 Jeu 3 Jan - 12:36 | |

| L'info de Chevron et sa succursale au Maroc sent l'arnque ! La source de toute cette information est l'annonce légal d'une société sur lematan.ma Comme deja posté par dan - Citation :

- CHEVRON MOROCCO EXPLORATION LIMITED

AU CAPITAL DE 10.000 $

11 Church Street, Hamilton, HM 11, Bermudes

RC Hamilton Bermudes n° 46720

Aux termes du procès verbal des décisions du Conseil du 22 octobre 2012 à Hamilton - Bermudes, enregistré à Casablanca en date du 19 novembre 2012,

La société sus-mentionnée, a décidé la création d’une succursale dénommée « CHEVRON MOROCCO EXPLORATION LIMITED MOROCCO BRANCH » à Casablanca au 219 Bd Zerktouni – 1er étage – Appartement n° 1 - Résidence El Bardai - Maroc. Le Directeur en sera Monsieur Ali Azizi, de nationalité américaine, né le 20 septembre 1958, titulaire du passeport n° 488987756 et demeurant 1400 Smith, Houston, TX 77002 (USA).

Le dépôt du dossier de constitution a été fait au Centre Régional d’Investissement de la Wilaya de Casablanca.

Son activité consiste en l’exploration pétrolière et gazière et la réalisation d’activités de production au Maroc.

La succursale a été immatriculée au Registre du Commerce de Casablanca sous le n° 271439.

Pour avis, le Représentant Légal Selon l'annonce la société "CHEVRON MOROCCO EXPLORATION LIMITED" crée une nouvelle société au Maroc "CHEVRON MOROCCO EXPLORATION LIMITED MOROCCO BRANCH" Le hic c'est que la première société est domiciliée à Bermudes, c'est un paradis fiscal ou autrement dis un paradis des sociétés d'arnaques qui disparaissent du jour au lendemain. En plus ce Monsieur Ali Azizi... demeurant 1400 Smith, Houston, TX 77002, alors que cette adresse est un siège professionnel de Chevron, comment ça se fait que le monsieur (avec un nom très générique Ali Azizi) habite le siège de la société Chevron USA alors que sa société elle même n'est pas domicilié à Texas mais à Bermudes (un paradis fiscal comme les iles Cayman, delaware....) C'est très louche. | |

|   | | Invité

Invité

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Jeu 3 Jan - 13:44 Jeu 3 Jan - 13:44 | |

| http://www.sec.gov/Archives/edgar/data/93410/000095012312002976/f60351exv21w1.htm - Citation :

- EX-21.1 6 f60351exv21w1.htm EX-21.1

Exhibit 21.1

SUBSIDIARIES OF CHEVRON CORPORATION1

At December 31, 2011

Name of Subsidiary State, Province or Country in Which Organized

Beta Offshore Nigeria Deepwater Limited

Nigeria

Cabinda Gulf Oil Company Limited

Bermuda

Chevron and Gulf UK Pension Plan Trustee Company Limited

England

Chevron Argentina S.R.L.

Argentina

Chevron Australia Pty Ltd.

Australia

Chevron Australia Transport Pty Ltd.

Australia

Chevron (Bermuda) Investments Limited

Bermuda

Chevron Brasil Petróleo Limitada

Brazil

Chevron Canada Finance Limited

Canada

Chevron Canada Limited

Canada

Chevron Capital Corporation

Delaware

Chevron Caspian Pipeline Consortium Company

Delaware

Chevron Environmental Management Company

California

Chevron Geothermal Indonesia, Ltd.

Bermuda

Chevron Global Energy Inc.

Delaware

Chevron Global Power Company

Pennsylvania

Chevron Global Technology Services Company

Delaware

Chevron International (Congo) Limited

Bermuda

Chevron International Petroleum Company

Delaware

Chevron Investment Management Company

Delaware

Chevron Investments (Netherlands), Inc.

Delaware

Chevron LNG Shipping Company Limited

Bermuda

Chevron Marine Products LLC

Delaware

Chevron Mining Inc.

Missouri

Chevron New Zealand

New Zealand

Chevron Nigeria Deepwater B Limited

Nigeria

Chevron Nigeria Deepwater D Limited

Nigeria

Chevron Nigeria Limited

Nigeria

Chevron Oil Congo (D.R.C.) Limited

Bermuda

Chevron Oronite Company LLC

Delaware

Chevron Oronite Pte. Ltd.

Singapore

Chevron Oronite S.A.S.

France

Chevron Overseas Company

Delaware

Chevron Overseas (Congo) Limited

Bermuda

Chevron Overseas Petroleum Limited

Bahamas

Chevron Overseas Pipeline (Cameroon) Limited

Bahamas

Chevron Overseas Pipeline (Chad) Limited

Bahamas

Chevron Pakistan Limited

Bahamas

Chevron Petroleum Chad Company Limited

Bermuda

Chevron Petroleum Company

New Jersey

Chevron Petroleum Limited

Bermuda

Chevron Philippines Inc.

Philippines

E-7

Name of Subsidiary State, Province or Country in Which Organized

Chevron Pipe Line Company

Delaware

Chevron South Natuna B Inc.

Liberia

Chevron Synfuels Limited

Bermuda

Chevron Thailand Exploration and Production, Ltd.

Bermuda

Chevron (Thailand) Limited

Bahamas

Chevron Thailand LLC

Delaware

Chevron Transport Corporation Ltd.

Bermuda

Chevron United Kingdom Limited

England and Wales

Chevron U.S.A. Holdings Inc.

Delaware

Chevron U.S.A. Inc.

Pennsylvania

Chevron Upstream and Gas

Pennsylvania

Four Star Oil & Gas Company

Delaware

Heddington Insurance Limited

Bermuda

Insco Limited

Bermuda

Iron Horse Insurance Co.

Vermont

Oilfield Concession Operators Limited

Nigeria

PT Chevron Pacific Indonesia

Indonesia

Saudi Arabian Chevron Inc.

Delaware

Texaco Britain Limited

England and Wales

Texaco Capital Inc.

Delaware

Texaco Captain Inc.

Delaware

Texaco Inc.

Delaware

Texaco Overseas Holdings Inc.

Delaware

Texaco Venezuela Holdings(I) Company

Delaware

Traders Insurance Limited

Bermuda

TRMI-H LLC

Delaware

Union Oil Company of California

California

Unocal Corporation

Delaware

Unocal International Corporation

Nevada

Unocal Pipeline Company

California

West Australian Petroleum Pty Limited

Australia

1 All of the subsidiaries in the above list are wholly owned, either directly or indirectly, by Chevron Corporation. Certain subsidiaries are not listed since, considered in the aggregate as a single subsidiary, they would not constitute a significant subsidiary at December 31, 2011.

E-8

|

|   | | juba2

General de Division

messages : 6954

Inscrit le : 02/04/2008

Localisation : USA

Nationalité :

Médailles de mérite :

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Jeu 3 Jan - 16:41 Jeu 3 Jan - 16:41 | |

| - atlasonline a écrit:

- L'info de Chevron et sa succursale au Maroc sent l'arnque !

La source de toute cette information est l'annonce légal d'une société sur lematan.ma

Comme deja posté par dan

- Citation :

- CHEVRON MOROCCO EXPLORATION LIMITED

AU CAPITAL DE 10.000 $

11 Church Street, Hamilton, HM 11, Bermudes

RC Hamilton Bermudes n° 46720

Aux termes du procès verbal des décisions du Conseil du 22 octobre 2012 à Hamilton - Bermudes, enregistré à Casablanca en date du 19 novembre 2012,

La société sus-mentionnée, a décidé la création d’une succursale dénommée « CHEVRON MOROCCO EXPLORATION LIMITED MOROCCO BRANCH » à Casablanca au 219 Bd Zerktouni – 1er étage – Appartement n° 1 - Résidence El Bardai - Maroc. Le Directeur en sera Monsieur Ali Azizi, de nationalité américaine, né le 20 septembre 1958, titulaire du passeport n° 488987756 et demeurant 1400 Smith, Houston, TX 77002 (USA).

Le dépôt du dossier de constitution a été fait au Centre Régional d’Investissement de la Wilaya de Casablanca.

Son activité consiste en l’exploration pétrolière et gazière et la réalisation d’activités de production au Maroc.

La succursale a été immatriculée au Registre du Commerce de Casablanca sous le n° 271439.

Pour avis, le Représentant Légal

Selon l'annonce la société "CHEVRON MOROCCO EXPLORATION LIMITED" crée une nouvelle société au Maroc "CHEVRON MOROCCO EXPLORATION LIMITED MOROCCO BRANCH"

Le hic c'est que la première société est domiciliée à Bermudes, c'est un paradis fiscal ou autrement dis un paradis des sociétés d'arnaques qui disparaissent du jour au lendemain.

En plus ce Monsieur Ali Azizi... demeurant 1400 Smith, Houston, TX 77002, alors que cette adresse est un siège professionnel de Chevron, comment ça se fait que le monsieur (avec un nom très générique Ali Azizi) habite le siège de la société Chevron USA alors que sa société elle même n'est pas domicilié à Texas mais à Bermudes (un paradis fiscal comme les iles Cayman, delaware....)

C'est très louche. Atlas c'est legite la companie,presque toutes les companie de grosse pointure aux USA ont leur succursle aux bermudes ,Bahamas etc,et c'est legale pour lal loi US croit moi,l'addresse du amrocain Azizi doit etre au siege de chevron qui est maintenant aussi chevron/mobile.Rien a craindre seulemnet maintenent je commence a croire au petrole au maroc un pettit peu.Si chevron commence a s'interesser c'est qu'il y a quelque chose qui cloche.En plus les americains ne sont pas comme les francais ils croivent mettre en place une oersonne du bled au poste de commandemant c'eat cela leur politic partout dans le monde. | |

|   | | simplet

General de Brigade

messages : 3192

Inscrit le : 20/05/2012

Localisation : MONTREAL

Nationalité :

Médailles de mérite :

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Ven 4 Jan - 15:26 Ven 4 Jan - 15:26 | |

| - dan a écrit:

info sur chevron interessante que je viens de trouver:

- Citation :

- Réf. : C-0069245/12

ANNONCES LEGALES

CHEVRON MOROCCO EXPLORATION LIMITED

AU CAPITAL DE 10.000 $

11 Church Street, Hamilton, HM 11, Bermudes

RC Hamilton Bermudes n° 46720

Aux termes du procès verbal des décisions du Conseil du 22 octobre 2012 à Hamilton - Bermudes, enregistré à Casablanca en date du 19 novembre 2012,

La société sus-mentionnée, a décidé la création d’une succursale dénommée « CHEVRON MOROCCO EXPLORATION LIMITED MOROCCO BRANCH » à Casablanca au 219 Bd Zerktouni – 1er étage – Appartement n° 1 - Résidence El Bardai - Maroc. Le Directeur en sera Monsieur Ali Azizi, de nationalité américaine, né le 20 septembre 1958, titulaire du passeport n° 488987756 et demeurant 1400 Smith, Houston, TX 77002 (USA).

Le dépôt du dossier de constitution a été fait au Centre Régional d’Investissement de la Wilaya de Casablanca.

Son activité consiste en l’exploration pétrolière et gazière et la réalisation d’activités de production au Maroc.

La succursale a été immatriculée au Registre du Commerce de Casablanca sous le n° 271439.

Pour avis, le Représentant Légal

publié le : 17.12.2012 AU CAPITAL DE 10.000 $ !!!! | |

|   | | RED BISHOP

Modérateur

messages : 12303

Inscrit le : 05/04/2008

Localisation : france

Nationalité :

Médailles de mérite :

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Ven 4 Jan - 15:31 Ven 4 Jan - 15:31 | |

| C'est un Capital de départ qui peut etre augmenter par la suite

sans parler des Compte Courant d'Associé _________________  | |

|   | | ready

Capitaine

messages : 945

Inscrit le : 21/07/2010

Localisation : loin !!

Nationalité :

Médailles de mérite :

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Ven 4 Jan - 17:56 Ven 4 Jan - 17:56 | |

| - simplet a écrit:

- dan a écrit:

info sur chevron interessante que je viens de trouver:

- Citation :

- Réf. : C-0069245/12

ANNONCES LEGALES

CHEVRON MOROCCO EXPLORATION LIMITED

AU CAPITAL DE 10.000 $

11 Church Street, Hamilton, HM 11, Bermudes

RC Hamilton Bermudes n° 46720

Aux termes du procès verbal des décisions du Conseil du 22 octobre 2012 à Hamilton - Bermudes, enregistré à Casablanca en date du 19 novembre 2012,

La société sus-mentionnée, a décidé la création d’une succursale dénommée « CHEVRON MOROCCO EXPLORATION LIMITED MOROCCO BRANCH » à Casablanca au 219 Bd Zerktouni – 1er étage – Appartement n° 1 - Résidence El Bardai - Maroc. Le Directeur en sera Monsieur Ali Azizi, de nationalité américaine, né le 20 septembre 1958, titulaire du passeport n° 488987756 et demeurant 1400 Smith, Houston, TX 77002 (USA).

Le dépôt du dossier de constitution a été fait au Centre Régional d’Investissement de la Wilaya de Casablanca.

Son activité consiste en l’exploration pétrolière et gazière et la réalisation d’activités de production au Maroc.

La succursale a été immatriculée au Registre du Commerce de Casablanca sous le n° 271439.

Pour avis, le Représentant Légal

publié le : 17.12.2012

AU CAPITAL DE 10.000 $ !!!! Ce capital te parait encore petit parce que l'entreprise n'a pas encore besoins de fonds propres aujourd'hui. Juste besoins d'une présence sur le nouveau marché ( le Maroc ). Les dépenses courantes seront probablement alimenté par des apports en compte courant. Le jour ou le besoins s'en fera sentir, il leur suffira de réunir une assemblée générale extraordinaire pour ajouter quelque zeros à ce capital. | |

|   | | Invité

Invité

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  Ven 4 Jan - 20:33 Ven 4 Jan - 20:33 | |

| Une confirmation "par la bande" des potentialités du Royaume. - Citation :

- Chevron Seen Eyeing Cobalt to Kosmos in Oil Hunt:Real M&A By Joe Carroll - Dec 6, 2012 10:49 PM GMT+0100

Chevron Corp. (CVX), the U.S. oil giant facing its longest slide in energy output in four years, could tap record cash to reignite growth by acquiring Cobalt International Energy Inc. (CIE) or Kosmos Energy Ltd. (KOS)

Oil and natural gas production from Chevron’s wells during the third quarter dwindled to the lowest since 2008, slashing profit by one-third and adding to declines that had already forced the world’s fourth-largest energy company to abandon its full-year output target. Even after the earnings drop, Chevron’s cash stood at an all-time high of $21.3 billion, exceeding that of bigger rivals Exxon (XOM) Mobil Corp. and Royal Dutch Shell Plc (RDSA), according to data compiled by Bloomberg.

While Chevron is spending more than $45 billion to harvest Australian natural gas fields that will produce enough of the fuel to supply all of China’s gas-import terminals, Phoenix Partners Group LP says the company still has ample resources to expand into nascent oil-exploration regions. Cobalt’s billion- barrel discovery off the coast of Angola could bolster Chevron’s deep-water African reserves, and Kosmos and Ophir Energy Plc (OPHR) control “significant” untapped deposits from Tanzania to Morocco, according to Tudor Pickering Holt & Co.

“Chevron is going to have to grow through acquisitions,” Chris Kettenmann, chief energy strategist at Phoenix Partners in New York, said in a telephone interview. “They are going to have to come to the market because they haven’t returned the $21 billion on the balance sheet to shareholders.”

'Heavy Investment’

Lloyd Avram, a Chevron spokesman, said in an e-mailed statement that the San Ramon, California-based company’s “cash position supports our long-held financial priorities,” and declined to comment on any acquisition plans. He referenced a March presentation to analysts in which Chief Financial Officer Pat Yarrington listed the company’s priorities, which included paying dividends, funding capital projects and returning surplus cash to shareholders.

“We are in a period of heavy investment and our cash balance allows us to weather lower commodity prices,” Avram wrote. “We view a strong balance sheet as a risk mitigation tool.”

Chevron, with a market value of $206 billion, said last month that it pumped 3.2 percent less oil and gas from its 56,000 wells during the third quarter compared with a year earlier, extending the company’s streak of production declines to a seventh straight quarter, the longest since a nine-quarter stretch that ended in 2008. Shutdowns related to weather and repairs contributed to the recent drop, the company said.

Lagging Behind

Chevron and other international oil producers have also seen production eroded as higher crude prices triggered contractual clauses in nations such as Nigeria that reduce foreign operators’ share of output from wells. Brent oil futures, the benchmark for two-thirds of the world’s oil, averaged about $111 a barrel since the end of 2010, a more than 55 percent increase from the prior two-year period.

Still, Chevron has underperformed competitors squeezed by the same global pricing mechanisms. Chevron’s production slide began in January 2011, six months before Exxon began registering a falloff in output and 18 months before Shell’s oil and gas volumes began to slip, according to data compiled by Bloomberg

Chevron, which said in March that it’s aiming to raise daily production by one-fifth by the end of 2017 to the equivalent of 3.3 million barrels of crude, has since said it won’t meet this year’s output goals. It’s spending almost $90 million a day this year to search for untapped reserves and build gas-export plants from the Indian Ocean to the Baltic Sea

Cash Pile

“Chevron is trying to grow through the drill bit, but when you can’t do that, you need to go get someone,” said Brian Youngberg, an analyst at Edward Jones & Co. in St. Louis.

Chevron has swelled its reserves of cash by more than 60 percent since the beginning of last year, in part to finance its share of costs for the construction of the sprawling Gorgon and Wheatstone gas-liquefaction complexes in northwest Australia. Its $21.3 billion in cash and equivalents as of Sept. 30 compared with $13.1 billion for Irving, Texas-based Exxon and $18.8 billion for The Hague-based Shell, according to data compiled by Bloomberg.

“Chevron certainly has the balance sheet to do large-scale M&A,” said Pavel Molchanov, an analyst at Raymond James Financial Inc. in Houston. “They have always used a blend of organic growth and acquisitions, it’s never been an either-or thing with them.”

Shelf Filing

Oppenheimer & Co. analyst Fadel Gheit wrote in a Nov. 14 note that he was “intrigued” when Chevron filed with regulators earlier in the month to issue debt, given the company’s cash hoard. The so-called shelf registration “leads us to think that Chevron may be prepared to make a large acquisition of a highly leveraged company and needs the additional cash to wipe out this high cost debt.” On Nov. 28, the company raised $4 billion in the bond market.

Oil explorers Cobalt, Ophir and Kosmos, which have stakes in untapped oil fields in some of the world’s most-promising offshore regions, could be appealing targets, said Matthew Portillo, Tudor Pickering’s vice president of exploration and production research in Houston.

Cobalt, the Houston-based deep-water oil explorer, announced a “significant” discovery in the Gulf of Mexico yesterday at a well in which it owns a 60 percent interest. The $11.6 billion company also has projects off Angola that Tudor Pickering estimates hold more than 1 billion barrels of crude.

Lynne Hackedorn, a Cobalt spokeswoman, declined to comment on whether the company has been approached by Chevron or would consider a sale.

‘Attractive Assets’

Today, Cobalt shares climbed 1.3 percent to $28.57 after jumping 19 percent yesterday on news of its oil discovery.

Kosmos, with a market value of $4.6 billion, continues to amass “very attractive” assets in oil-rich coastal zones of Ghana, Cameroon and Morocco and could be a good takeover candidate for an international oil producer such as Chevron, Portillo said. The Dallas-based company is led by the management team that scored a series of exploration triumphs off the African coast in the 1990s for Triton Energy Ltd., which later sold to Hess Corp.

Brad Whitmarsh, a spokesman for Kosmos, didn’t return a phone message seeking comment.

“Kosmos has a lot of potential,” Portillo said in a phone interview. The company “has a lot of very attractive assets and high-impact exploration prospects.”

Seeking Partner

Today, Kosmos climbed 2.4 percent to $12.16, its highest closing level in seven months.

London-based Ophir, the biggest holder of drilling rights in East Africa, has gas holdings in Equatorial Guinea and Tanzania ripe for export to European and Asian markets.

Ophir is seeking a partner with deep pockets to help build a liquefaction plant for its Equatorial Guinea gas, Chief Executive Officer Nick Cooper said in a Nov. 28 interview. The $3.3 billion company may seek a buyer for as much as half of its 80 percent stake in the offshore zone known as Block R, Cooper said then.

Cooper’s office directed requests for comment for this story to an outside spokesman, who didn’t return a phone message.

Today, Ophir shares fell 0.1 percent to 507.50 pence.

Hefty Expenses

The hefty outlays required at the Gorgon and Wheatstone projects may temper Chevron’s appetite for acquisitions, said Robert Sweet, who helps manage $150 million at Horizon Investment Services in Hammond, Indiana. The facilities, which will chill gas to a liquid form so it can be transported by tankers to China, Japan and other markets, are scheduled to begin operations in 2014 and 2016, respectively.

Chevron’s 47.3 stake in Gorgon means it will likely pay about $25 billion of the total estimated cost of just over $50 billion. Its stakes in various segments of the Wheatstone project indicate Chevron will be on the hook for more than $20 billion.

Chevron has another $7.6 billion committed to four deep- water developments in the Gulf of Mexico and off the Newfoundland coast, all of which are scheduled to commence production in 2014.

While Chevron may have the resources to pursue a takeover, shareholder Toronto-Dominion Bank said it doesn’t want the company to feel it needs to make an acquisition just to boost output.

‘Right Things’

“They’ve been bolstering their cash balance and doing all the right things that a disciplined company should do,” Ari Levy, Toronto-based manager of the TD Energy Fund, said in a phone interview. “We wouldn’t want to see them deviate from that for the sake of an opportunistic acquisition. The focus should be on adding value as opposed to pure production growth for production growth’s sake.”

Still, Chevron could use some of its cash pile to buy oilfield-services provider Weatherford International Ltd. (WFT) and take the sting out of its surging costs for such services and well equipment, said Laurence Balter, who helps manage $100 million, including Geneva-based Weatherford and Chevron shares, at Oracle Investment Research in Fox Island, Washington. Karen David-Green, a Weatherford spokeswoman, didn’t return a phone message seeking comment on a possible takeover by Chevron.

Today, Weatherford shares rose 1.2 percent to $10.86.

“With Weatherford, Chevron could control costs and extend their tentacles,” Balter said. “It would be an ‘out-of-the- box’ move.” |

|   | | Contenu sponsorisé

|  Sujet: Re: Maroc exploitation du Gaz/pétrole lourd Sujet: Re: Maroc exploitation du Gaz/pétrole lourd  | |

| |

|   | | | | Maroc exploitation du Gaz/pétrole lourd |  |

|

Sujets similaires |  |

|

| | Permission de ce forum: | Vous ne pouvez pas répondre aux sujets dans ce forum

| |

| |

| |

|